Year-End Accounting Checklist for Nonprofit Organizations

Between internal financial policies, legal requirements, and donor expectations, nonprofits face unique challenges when closing the fiscal year. Accurate year-end accounting is critical for maintaining transparency, compliance, and donor trust.

However, diverse revenue sources, grant restrictions, donor designations, and other considerations make the year-end close a tricky process for nonprofits. Review this checklist for a step-by-step guide to streamline the year-end close.

1. Review and Reconcile Accounts

Accurate account reconciliation is essential for identifying discrepancies and catching potential errors. This complete picture of your nonprofit’s finances is critical for closing out the year with confidence in the accuracy of your records.

Follow these steps to reconcile your accounts at the year-end close:

- Ensure bank account balances match bank statements

- Cross-check all outstanding receivables and payables

- Ensure that expenses are coded to the appropriate restricted fund, if applicable

2. Assess Revenue and Contributions

Evaluating the revenue and contributions your nonprofit received in the fiscal year is important for compliance and transparency.

Checking to ensure revenue is accurately recorded ensures your books are in compliance with Generally Accepted Accounting Principles (GAAP). Additionally, this assessment confirms that your reports to donors, board members, and regulatory bodies are based on accurate data.

Here’s what to check when assessing revenue and contributions:

- Double-check donations received to ensure all cash and in-kind contributions are accurately recorded.

- Verify that restricted revenue is recorded in compliance with donor designations.

- Verify that grant revenue is recorded in a manner consistent with the grant agreement and GAAP.

- Ensure all membership fees and program revenue are properly classified.

3. Prepare and Review Financial Statements

Financial statements provide overviews of your financial position, allowing stakeholders to understand your financial activities. These financial reports must contain accurate and holistic information to properly convey your nonprofit’s financial status.

Here’s what you should review in each financial statement at the end of the fiscal year:

- Statement of financial position

- Ensure the accuracy of reported assets, liabilities, and net assets.

- Statement of activities

- Identify any variances in budgeted and actual figures.

- Review revenue and expenses for accuracy.

- Statement of cash flows

- Ensure cash inflows and outflows are accurately recorded for all operating, investing, and financing activities.

- Statement of functional expenses

- Verify that expenses are recorded correctly.

4. Conduct an Internal Audit or Review

Closing out the fiscal year with an internal audit prepares your nonprofit to make necessary operational changes for the next year. For example, if the audit reveals a gap in your internal controls, your team can address the gap and prevent it from occurring next year.

Follow these steps to conduct an internal audit:

- Review internal controls and determine whether any areas need strengthening, such as cash handling or expense reporting.

- Verify documentation for transactions and confirm they comply with internal policies.

- Check for signs of financial irregularities or unusual activity in expense reports, vendor invoices, and other records.

- Gather and organize all relevant documents for an external audit, if needed.

5. Evaluate Grant Compliance and Reporting

The grants your nonprofit receives throughout the fiscal year may be subject to unique restrictions and reporting requirements. Evaluate your grants at the year-end close to ensure you have met (and continue to meet) grant conditions.

To thoroughly review all grants, follow these steps:

- Confirm that grant funds were properly recorded, tracked, and spent according to stipulations and GAAP.

- Compile required reports for grantors where applicable.

- Identify renewal opportunities for the coming year.

6. Plan for the Next Fiscal Year

Think of year-end accounting as a full-circle process. You’re reviewing the most recent fiscal year in preparation for the upcoming one.

Planning for the next fiscal year enables your nonprofit to learn from its recent performance and set goals accordingly. Plus, it provides a clear roadmap for implementing improvements and tightening your financial sustainability.

Here’s how you should prepare for the next fiscal year:

- Identify strategies for potential revenue growth or retention.

- Set future revenue, contribution, and expense goals based on strategic plans.

- Set benchmarks for the upcoming year’s spending.

- Use year-end financial insights to prepare a budget for the upcoming fiscal year.

- Present the new financial plan and budget to the board.

7. Work with a Nonprofit Accountant

Whether your nonprofit already outsources accounting or handles it in-house, the end of the fiscal year is the optimal time to lean on a professional accountant’s expertise. As Chazin & Company’s nonprofit accounting guide explains, a professional’s guidance provides convenience for your team and peace of mind that your nonprofit’s finances are in the hands of a reliable expert.

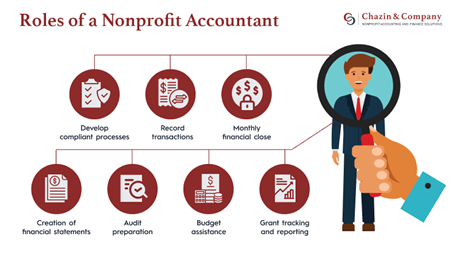

Nonprofit accountants offer specialized knowledge concerning tax laws, reporting standards, and other requirements your organization must follow. Additionally, they can help your nonprofit in the following ways:

- Develop compliant processes

- Record transactions

- Monthly financial close

- Creation of financial statements

- Audit preparation

- Budget assistance

- Grant tracking and reporting

To ensure you receive guidance relevant to your specific needs, look for an accountant with nonprofit experience and a strong grasp of tax-exempt laws.

Use this checklist as a starting point, but build it out to account for your nonprofit’s unique bookkeeping and financial processes. Keep in mind that a professional accountant can help your nonprofit develop a plan for its year-end close or even handle the process for you. This way, you can rest assured that your finances are in order without taking your focus from your mission.